|

| Environmental Economics-Part A-Lecture 1-ageconbd.com |

Externality: It refers to no fault occurred by oneself, but has to bean sufferings for other's activity. For instance, Forest fire of Australia.

Cost impacts benefit.

Developed countries are responsible for changing the global climate. We observe that Third world country's people have to suffer. To give a clear example, the emission of gas per head of China in 2007.

Resources are limited, but it has alternative uses.

“What is an economic problem? Which arise economic problems? Unlimited wants but limited resources arise economic problems. For clearing up economic problems, awareness is not enough. Respect for the law is essential.

Environmental economics is educated for creating awareness. Awareness is basic for solving economic problems. Then execution of awareness is to be done.

An example of a public good is a road. Hamper of respire system is executed by the dust of the road. Here, the impact of road is recognized as a negative externality.

A policy-maker must know externalities.

The contrast between income and profit is that earned something such as money is termed as income.

The producer concentrates on revenue and cost. His view is individual thinking.

Private production cost: It refers to a producer’s cost of providing goods or services. It covers internal costs incurred for inputs, labor, rent, and depreciation but rejects external costs incurred as environmental damage.

The contrast between private production cost and social production cost is private production costs are recognized as only one part of overall social production costs. Social production costs consider not only private production costs, but also the externalities that come as a result of a given economic decision.

Example of external costs or externalities: External costs or externalities denote the core economic concept of uncompensated social or environmental effects. For instance, when people purchase fuel for a car, they pay for the production of that fuel (an internal cost), but not for the costs of burning that fuel, such as air pollution.

The social cost is termed as the total cost to society. It contains both private costs plus any external costs. For instance, an example of the social cost is the cost incurred when driving a car.

The water of the Buriganga river is denoted as public property. People are suffering from asthma due to smoking of brick-fields. Brick-fields generates air pollution. Producers do not concentrate on the death of people due to air pollution.

Stop of mosquitos' breeding brings advantage to neighbors. Taking vaccines brings advantages to other persons.

The producer or consumer impacts a third party. To give an example, the fuel of motorcycles.

A beautiful example of positive externalities is flower production. Bees gather honey from flowers.

A realistic example of negative externalities is sound pollution through the mike. Sound pollution occurs beside the heart hospital.

A charming example of a positive production externality is the production of bees. A realistic example of positive consumption externality is stopping mosquito production. Taking a vaccine is another good example of a positive consumption externality.

Negative production externalities are denoted as those production externalities that create pollution. A clever example of negative consumption externality is smoking, playing cards.

Costs are of two types- implicit cost and explicit cost.

Implicit cost: It is the cost where the owner's labor, family labor are invested. No cost is calculated in implicit cost.

Explicit cost: It is the cost which is gone out of pocket is explicit.

Social cost: Society's cost because of the production of goods is called social cost. Society carries the cost to the safe health of society's people.

The social cost is less than the private cost indicates externalities are positive.

Marginal cost: Consumer expends money to consume extra one unit. Mathematically (n-1) indicates an extra one unit whereas n is unit measurement.

Marginal Social Cost = Marginal Private Cost + Marginal External Cost

The social cost of technology is demolishing social bondings.

Marginal benefit: It is the benefit that a person gets, society's benefit is not calculated.

The utility is revealed in terms of all price - Marshall

Marginal External Benefit: It denotes benefitting other persons by consumption of one person.

Marginal social benefit = Marginal Private Benefit + Marginal External Benefit

Suppose, getting BDT 5,000 profit through selling a car is a private benefit. Because of air pollution through cars, the loss of society is BDT 1000 as an externality. So, the marginal social benefit is less than marginal private benefit will equal to BDT 4000.

Different kinds of goods:

Goods are of two types - Excludability and Rivalry.

Excludable goods can block people from enjoying the goods. For instance, luxury goods such as iPhones are excludable goods.

Rivalry goods or rivalry is a type of good that may only be owned or absorbed by a single user. These items can be long-lasting and they may only be used one at a time or non-durable which means consumers demolish them after consumption, allowing only one user to enjoy it. When a good is rival in consumption, competition for the rival good can take place in the case of bidding of people to buy a particular house.

Suppose, getting BDT 5,000 profit through selling a car is a private benefit. Because of air pollution through cars, the loss of society is BDT 1000 as an externality. So, the marginal social benefit is less than marginal private benefit will equal to BDT 4000.

Different kinds of goods:

Goods are of two types - Excludability and Rivalry.

Excludable goods can block people from enjoying the goods. For instance, luxury goods such as iPhones are excludable goods.

Rivalry goods or rivalry is a type of good that may only be owned or absorbed by a single user. These items can be long-lasting and they may only be used one at a time or non-durable which means consumers demolish them after consumption, allowing only one user to enjoy it. When a good is rival in consumption, competition for the rival good can take place in the case of bidding of people to buy a particular house.

Scarcity is a comparative term. It is impossible to satisfy the want of all people in society.

Suppose, 5 persons and 3 pieces of bread exist in a place. It shows a rivalry situation. A good will be rival if using the good by anyone decreases the quantity available for someone else.

Demand relies on utility. If no utility exists, no demand will arise. For instance, rotten 25 eggs have no utility and that is why they do not create demand for the existing 15 persons.

Common resource: Water of Buriganga river

Public goods: General knowledge, Road, National Defense. Everybody can use and no tax is to be given.

Private goods: Car is an example of a private good.

Natural Monopoly example: The Internet is an example of a natural monopoly.

Public Goods and the Free Rider Problem

The market economy reveals that price influences both the buyers and sellers.

Marginal benefit is termed as the vertical summation of individual benefit. The marginal demand curve is termed as the horizontal summation of individual demand.

Public goods design a free-rider problem - the absence of an incentive to pay for what they consume.

The value of a public good is termed as the maximum amount that all the people are willing to pay for one more unit of it. To measure the value placed on public goods, we use the concepts of total benefit and marginal benefit.

| |

|

The economy's marginal social benefit of a public good is termed as the sum of the marginal benefits of all individuals at each quantity of the good provided. The economy's marginal social benefit curve for the public good is termed as the vertical sum of all individual marginal benefit curves.

The marginal social benefit curve for the public good goes against the demand curve for a private good, which is the horizontal sum of the individual demand curves at each price.

The Efficient Quantity of a Public Good

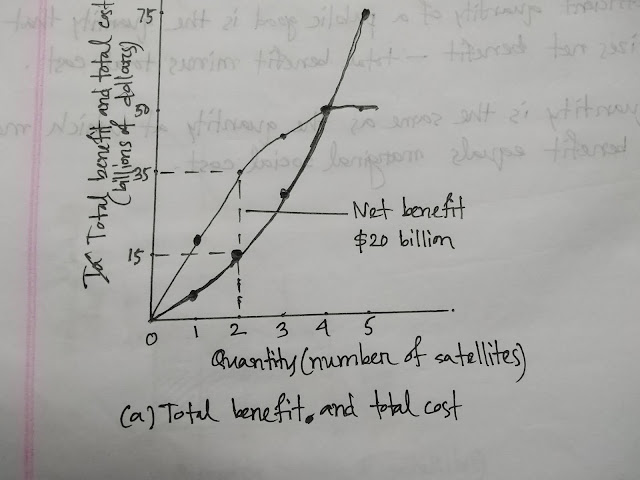

The efficient quantity of a public good is termed as the quantity that maximizes net benefit – total benefit minus total cost. This quantity exists the same as the quantity at which marginal social benefit equals marginal social cost.

The total cost curve, TC, is like the total cost curve for a private good.

The total benefit curve, TB, is just the sum of the marginal benefit at each output level.

The efficient quantity is ensured where the net benefit is maximized.

The efficient quantity of a public good indicates the quantity that maximizes net benefit – total benefit minus total cost - which is the same as the quantity at which marginal benefit equals marginal cost.

The marginal benefit curve, MB, is one that we have just derived.

The marginal cost curve, MC, is just like the MC curve for a private good.

The efficient quantity is ensured where marginal benefit equals marginal cost.

6 soybean companies have an existence in the market of Bangladesh. If market control does not stay, the efficiency of resources will be decreased.

Economic efficiency expresses an economic state in which every resource is optimally allocated to serve each individual or entity in the best way while minimizing waste and inefficiency. When an economy is economically efficient, any changes made to assist one entity will harm another.

In Bangladesh, technical and industrial knowledge is bad Due to the poor production process, Dhaka becomes first in air pollution.

The economist will give a concrete analysis of the concrete situation. For instance, an economist will give the analysis of demand for onion in the recent situation.

Free rider signifies consumption without giving money for it such as public goods.

0 Comments